Section 3: Dealer Bonds, Title and Registration Procedures

$50,000 Dealer Bond

The general rule is that most dealers must maintain a $50,000 bond at all time. The bond must be on file or submitted prior to renewal of the dealer’s license. The bond effective date must also be prior to the current license expiration date.

Exceptions: $10,000.00 Bond

- Motorcycle-only dealers need only a $10,000.00 bond

- Wholesale-only dealers selling less than 25 vehicles per year need only a $10,000.00 bond.

- The dealer bonds ($50,000, or $10,000), must be continuously on file with the DMV. If your bond expires your license is immediately cancelled, (not suspended), and you must surrender it to the DMV. You then have to apply for a whole new license.

Bond Company Recommendations

YourCarDealerBond.com. We continually ask our long time dealers, and new dealers, for their their feedback/recommendations for the best bond rates. The most recommended company, by far, has been YourCarDealerBond.com.

We contacted YourCarDealerBond.com to follow up and verify their rates. They offered to provide dealers taking our course their preferred dealer rates. To get their best rates, e-mail Mike Ramos at Mike@yourcardealerbond.com. Mike is the president of the company, not a commissioned salesperson. Tell him you are Motorsports Market continuing education dealer to get their preferred dealer rates.

Methods of Compliance

- File a Surety Bond of Dealer, form OL25, executed by an admitted surety insurer in the amount of $50,000.

- File a $50,000 cash deposit with DMV with Form OL64, or OL65 as required. You can get these forms at same link as above. Remember, the DMV may keep your $50,000 cash bond for up to three years after you cease business to satisfy any potential claims that may surface during that time.

- File a rider to your current bond stating the bond amount is increased to $50,000. The rider must also indicate that a financing agency may make a claim to the bond.

E-Mail Alert System

- All dealers should subscribe to DMV’s e-mail notification system to receive Vehicle Industry News memos, and other important dealership rule and regulation information and changes. You can sign up for this free service here.

Types of California Title

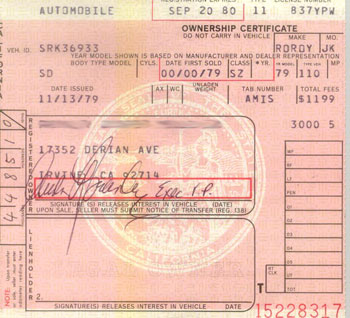

Non-Complying Title

Non-complying titles are older California titles (“pink slips” and pre-1994 “rainbow” titles). These titles do not have a space for the buyer to sign the odometer disclosure. Only the seller had to sign the odometer disclosure on the non-complying titles. If the title is not available at the time of sale, use the Reg. 262 form to acknowledge the odometer reading.

Complying Title

Complying titles contain the federally mandated odometer disclosure section that includes a space for the buyer to sign the odometer disclosure as well as the seller. [V.C. §4451]. Some other features of the complying titles include:

- “Void” appears on copies made of the title.

- Vehicle history (“branding”) is displayed in red box in upper right hand corner.

- The Title and Salvage Certificates have a California bear watermark on the right side that can be seen when the document is held up to a light.

- Micro printed wording is located in the odometer sections to expose any attempts to erase the reported mileage.

- Reactive chemicals are incorporated into the documents to expose attempts at chemical alterations.

Completing Titles for Transfer

Signature Requirements

Upon transfer, the legal owner, registered owner, and the transferee must sign the certificate of ownership. The transferee must also provide his or her address on the certificate of ownership. [V.C. §§5600, 5750, and 5751]

Seller’s Signatures

You must make sure the person signing the title is the same as the person whose name appears on the title. Verify their identity by examining their driver’s license or other legal i.d. Also make certain the seller’s signature is legible (readable). Where the signature is not clear, or is in any way confusing, you must submit a Name Statement explaining why the signature appears contrary to the printed name. An example would be a title with the name “Ryan Alexander Peterson” and the seller signs off as “Al Peterson.” To submit this information use the REG 256 form found here.

Co-Owners

- If co-owners are joined by the word “and” or a ” / ” mark, then both must sign the title to release their interest in the vehicle.

- If co-owners joined by “or”, or “and/or”, one owner must sign.

- If co-owners with a “JTRS”, then both owners must sign.

- If a leasing company, the lessor (the leasing company) must release the vehicle with the company’s name and countersignature from an authorized representative. Note: The lessee is not an owner.

- If a business, then the business name and an authorized counter signature must appear.

- If a sole proprietor with a DBA, then the individual owner must sign.

- Note: A bill of sale is acceptable in lieu of the owner’s signature on Line 1 of the Title.

Buyer’s Signatures

- Back of Title: Have each new owner (the buyers) sign, or their signatures may be signed by power of attorney for the buyers.

- New Legal Owner/Lienholder Section: If applicable, enter name of new legal owner. If none, write the word “None” in this section. Failure to do so will result in a returned application.

For Dealer Sales

The buyer must sign as the new registered owner and in the Dealer Only section as the buyer acknowledging the odometer mileage reported. If the dealer odometer disclosure section has been completed and additional disclosure is required, a separate Vehicle/Vessel Transfer Form (REG 262) must be completed and signed.

For Private Party Sales

- The registered owner must put the odometer reading on the front of the title. The buyer endorses the reverse side of the title acknowledging that same mileage.

- If the title is a complying, out-of-state title (for “golden rod” conversion), the odometer disclosure must be in the designated area on the title.

- If the title is a non-complying title: a Vehicle/Vessel Transfer form (REG 262) must be completed.

- If the Title is unavailable at the time of sale (i.e, if the lienholder has it, or it is paperless), a Vehicle/Vessel Transfer form (REG 262) must be completed.

- If using an Application for Duplicate Title (REG 227): A Vehicle/Vessel Transfer form (REG 262) must be completed.

- If the title is submitted with a multiple transfer application: A Vehicle/Vessel Transfer form (REG 262) must be completed by both the buyer and seller for each transaction.

- Auto Auctions: Must maintain the original copy of its sales invoice. A carbon copy of the invoice is acceptable for disclosure of odometer mileage.

No highlighting pens

Do not use highlighting pens on any registration forms being submitted to the DMV. You application will be rejected and returned.

Other Transfer Requirements

The transferee (Dealer) must mail or deliver to DMV the endorsed certificate of ownership (except in out-of-state sale situations) along with:

- The proper transfer fee;

- An application for transfer of registration. [V.C. §5600]

- An odometer mileage statement must be provided by the transferor or person in physical possession of the vehicle [V.C. §5900]. On a complying title, the buyer must handprint his/her name and sign acknowledging the odometer mileage being reported. On a non-complying title, enter the odometer reading on the REG 262 form. See also the section on Odometers later in this book.

- Smog certificate (or electronic transfer) [V.C. §4000.1]

- Report of Sale – Used vehicle form for filing by dealer with DMV

- Other supporting documents – where applicable.

- Vehicle/Vessel Transfer Form, Reg. 262, which contains a power of attorney, odometer disclosure, and bill of sale

- Note: The Dealer must also remit the sales and use taxes to the Board of Equalization.

Power of Attorney

- A power of attorney is a written document designating someone to act on behalf of the principal to transfer ownership and/or complete necessary documents as required by law. [C.C. §2410]

- May be used to endorse for a buyer or seller. If used, the original power of attorney must be submitted with the transfer application.

- May not be used to disclose odometer mileage.

- Most dealers use the Power of Attorney section found at the bottom of the Reg 262 form.

Registration Fees [V.C. §4000]

Registration fees are due at time of retail sale if:

- The registration has already expired.

- The registration will expire within 30 days of the date of sale. [V.C. §5902.5]

- The vehicle is from out-of-state.

- A registration certificate and fees are not required when the registration expires on a vehicle while in a dealer’s inventory, or pending a lien sale. However, registration fees become due and must be paid within 30 days of the date of sale. [V.C. §4604]

- If a vehicle has expired registration when the dealer acquires it, the dealer should immediately post fees with the DMV to pay those penalties and prevent the penalties from increasing.

A dealer may not include, as an added cost to the selling price of a vehicle, an amount for licensing or transfer of title of the vehicle, which is not due to the state unless, prior to the sale, that amount has been paid by a dealer to the state in order to avoid penalties that would have accrued because of late payment of the fees. However, a dealer may collect from the second purchaser of a vehicle a prorated fee based upon the number of months remaining in the registration year for that vehicle. This is allowed in circumstances where the vehicle had been previously sold by the dealer, the sale was subsequently rescinded, and all the fees that were paid under the Revenue and Taxation Code were returned by the dealer to the first purchaser of the vehicle.

Registration Fee and Calculator

Registration fees can be calculated using the DMV’s Vehicle Registration Fee Calculator here. [V.C. 9250].

Transfer Fee

The Transfer fee is currently $15.00. [V.C. §9255]

Transfer Time Requirements

- A dealer shall submit the Report of Sale to DMV at the time of sale using the Business Partner Automation program or Fairfax Imaging. The remainder of the application must be submitted within 30 days of the date of sale. [V.C. §4456(a)(2)]

- Where the registration of the vehicle expires while the vehicle is in the dealer’s inventory, the registration fee must be paid within 30 days of the date of sale.

- Where a certificate of non-operation is on file and ownership of the vehicle is transferred, the buyer has 30 days from the date the vehicle is first operated or moved on the highway to apply for transfer and registration without incurring a penalty. [V.C. §4604(c)(2)]

Out-of-State Deliveries

When the buyer is not from California, and will not be registering the vehicle in California, California registration fees are not due if the vehicle is transferred to the out-of-state buyer using one of the methods below:

One Trip Permit [V.C. § 9258]

A One Trip Permit may be issued by the DMV for operating any of the following vehicles, except a crane:

- A vehicle while being moved or operated unladen for one continuous trip from a place within this state to another place either within or without this state or from a place without this state to a place within this state.

- A vehicle while being moved or operated for one round trip to be completed within 60 days from one place to another for the purpose of participating as a vehicular float or display in a lawful parade or exhibition, provided that the total round trip does not exceed 100 miles.

One Trip Permits shall be posted upon the windshield or other prominent place upon a vehicle and shall identify the vehicle to which it is affixed. When so affixed, such permit shall serve in lieu of California registration. [V.C. § 4003]

Blank One Trip Permits can be purchased in volume (a booklet) from any DMV office.

Out of State Registration

If the vehicle is registered out of state before delivery, the out of state plates and registration may be used to transport the vehicle out of California.

Shipping by Truck

If the vehicle is transported by truck (certified common carrier is required) to the buyer in another state, no California registration fees are due.

Dealer Delivery over State Lines

If the dealer transports the vehicle across the California state line and there delivers it to the buyer, no California registration fees are due. This act of delivery must be witnessed by a notary in the state where the vehicle is delivered. Retain the notarized document for you files.

Report of Sale Documents for Out of State Sales

When processing a vehicle that is being sold for registration outside of California:

- Complete the Report of Sale-Used Vehicle and mark it “For registration in another state.”

- Complete Statement of Facts (REG 256) explaining how vehicle was moved.

- Note: The buyer must transport the vehicle (by truck) or move it on a One Trip Permit (REG 402) unless registration in the buyer’s home state is obtained prior to movement of the vehicle. Dealer plates cannot be used to move the vehicle. (Section 2.050, DMV Dealer Handbook). However, dealer plates may be used to deliver a vehicle when title does not pass to the purchaser until after delivery. (Section 18.030, of the DMV Dealer Handbook)

Note: Using a One Trip Permit avoids registration fees, but not sales tax!

See also “One Trip Permits” later in this course.

Out of Country Sales

When the dealer sells a vehicle for export to another country the selling dealer must complete one of the following forms:

- The Used Vehicle Report of Sale for sales to retail buyers, or

- The Wholesale Report of Sale if the sale is wholesale transaction with a dealer from another country.

The dealer must mark the Application for Registration, or the Report of Sale “For export to another country.”

The dealer must also complete a Statement of Facts (REG 256) explaining how the vehicle was moved. The vehicle must be moved by a One Trip Permit (REG 402) to avoid registration fees, unless the sale is completed after the vehicle was delivered. In that case the vehicle can be delivered with a dealer plate.

The dealer must remove the plates on the vehicle and turn them into the DMV. [V.C. §11725 (a)]

To make certain you are complying with the Department of Tax and Fee Administration requirements, especially with regard to exporting to Mexico, you may want to obtain the Dept.’s “Sales to Purchaser’s From Mexico” publication. You can find it here.

Quick Titles

You may obtain a “quick title” within 72 hours of submitting the proper transfer forms and fees to DMV Special Processing Unit in Sacramento for an additional fee. See V.C. §9270

Excess Fee Refund

Where the purchaser pays the dealer excess taxes or fees, the dealer must return the excess amount, whether the purchaser requests it or not. [V.C. §11616, and 11713.4]

Dealer Bundle Listing, FO 247 Form

The DMV provides dealers Transmittal of Registration Applications (FO 247) forms for listing registration applications submitted to the DMV. This provides dealers and the DMV a means of tracking multiple applications. Dealers may process up to 5 applications at any one time without listing them on the FO 247 using the appointment system at your local DMV office. The FO 247 forms can be found here.

The FO 247 must be submitted in duplicate, but can be prepared in triplicate if the dealer would like a receipt. DMV keeps the original and returns the duplicate after the applications have been processed. DMV prefers a separate check for each transmittal.

No Scrunching! When filling out the FO 247, you may use two lines, if necessary, instead of scrunching all of the information onto one line. Accuracy, neatness, and clarity are vital on these forms.

“Posting Fees”: You can also note on the FO 247 when you are just posting fees for a particular vehicle.

“Credit” or “Refund”: Check “credit” or “refund” (of excess fees) on the FO247 so the DMV knows whether to credit any excess amount paid or to refund you the excess. Note that this applies to the entire bundle. Also, make sure than if DMV refunds the excess fees that you, in turn, refund those excess fees to the buyer that paid them in the first place.

For Pick Up or Mailing: When submitting the FO 247, indicate if the completed work is to be picked up in person or mailed to the dealership. Plates, reg. cards and stickers will be mailed to the registered owner directly from Sacramento unless otherwise specified in the application.

DMV Processing: When DMV receives the bundles they will

- Enter the date received;

- Verify the number of applications received; and

- Assign a “bundle number” so that it can be tracked.

Administrative Service Fees (“ASF”)

After DMV has processed and cashiered the application a copy of the transmittal and any returned (RDF) items are returned to the dealer. Any ASF information will appear on the transmittal.

Reports of Sale

The dealer must submit their Reports of Sale electronically at the time of sale, using either the Business Partner Automation program, or through Fairfax Imaging. See our course section on AB 516 for further information about this procedure.

Notice of Sale Form – No longer needed

The Notice of Sale form (aka the “Five Day Notice”) is no longer used since the passage of AB 516. Because the dealer submits their Report of Sale electronically at the time of sale, DMV already has “notice” that the vehicle has been sold, and to whom. The DMV does not need an additional notice of the sale.

Notice/Temporary Identification

- The temporary operating copy of the notice of sale section must be attached for display on the vehicle immediately upon the sale of the vehicle. [V.C. §4456]

- The temporary operating copy is to be displayed within a seven inch square in the lower right hand corner of the windshield. [V.C. §§11715(e)(2), and 26708 (b)(3)]

- For a motorcycle, the temporary operating copy must be displayed in a conspicuous manner upon the vehicle. [V.C. §11715(e)(1)]

- AB 516 Note: When the dealer sells a vehicle that does not have California plates already assigned to it, the dealer will print out a Temporary License Plate (“TLP”), and mount it on the rear of the vehicle where the rear license plate would normally be placed. The dealer will still attach the temporary operating portion of the Report of Sale to the windshield of the car.

Other DMV Registration and Miscellaneous Forms

For registration related forms, click here.

For other general DMV forms, click here.

Forms that cannot be obtained over the Internet (such as “secure forms”, like the Reg 262) can be obtained from the DMV at the following address:

DMV

Forms and Accountable Items Section MS G202

P.O. Box 932382

Sacramento, CA 94232-3820

Administrative Service Fees

Administrative Service Fees (“ASF”) are penalties imposed by the DMV on a dealer for failing to submit Reports of Sale and related documents to the DMV on time. The dealer will be subject to an Administrative Service Fee for each of the following infractions:

- $5.00 Failing to attach copy of Notice/Temporary ID on vehicle (the “window copy” of the ROS)

- $5.00 Failing to submit Transfer/Registration Application to DMV within 30 days of date of sale

- $25.00 Failing to correct a returned application within 50 days of sale date or 30 days of the date the application is returned by DMV, whichever is later

- $25.00 Failing to correct a returned application within 50 days of sale date or 30 days of the date the application is returned by DMV, whichever is later

Each infraction for which an ASF is charged is a separate cause for disciplinary action pursuant to [V.C. §§11613 or 11705] So even though the dollar amount of these fees may seem small, each failure to submit your paperwork on time is a separate violation. This could subject you to additional administrative penalties, such as a refusal to issue a new license.

Wholesale Reports of Sale

AB 516 requires wholesale dealers to submit the Report of Sale electronically at the time of sale, either using the Business Partner Automation program, or Fairfax Imaging. The “Five Day Notice” no longer needs to be sent to DMV.

E-Mail Alert System – Vehicle Industry News (VIN) Emails

All dealers should subscribe to DMV’s e-mail notification system to receive Vehicle Industry News memos, and other important dealership rule and regulation information and changes. To sign up for this free e-mail service, click here.