Section 2: Car Buyer’s Bill of Rights

The Car Buyer’s Bill of Rights (AB 68) –

signed into law by Governor Arnold Schwarzenegger, made major changes to rules and procedures affecting the retail sales of used vehicles for less than $40,000. There is a 2 day cooling off period, specific rules about advertising your vehicles as “Certified,” and rules about disclosing customer credit scores, including finance charge limits between 2% and 2.5%. If your dealership fits this category, we strongly encourage you to carefully read the sections below. They are full of valuable information and tips to help you easily comply with the Bill’s rules.

Two Day Cooling Off Period

Used motor vehicles dealers must offer a Two Day Cooling Off Period Option to Retail buyers of vehicles sold for Less than $40,000.00. This excludes motorcycles, recreational vehicles and off-road vehicles.

The retail buyer can return the vehicle for any reason within two days of taking delivery, provided that he or she has driven fewer than 250 miles (or higher if the dealer agrees). The vehicle must be returned “Undamaged, except for defects/problems that became evident after delivery. ” “Undamaged” means in substantially the same condition as at time of delivery, normal wear and tear excepted. The dealer gets to determine whether the vehicle is undamaged and in substantially the same condition as at time of delivery.

The Two Day Cooling Off Period option must be a separate document from the sales contract, often called a “Contract Cancellation Option Agreement”, or “Cancellation Agreement.” See details below.

If the vehicle is returned within the required two day period, the dealer must cancel the contract and provide a Full Refund to the buyer within two days of the date of cancellation. A “Full Refund” includes sales tax, and reg. fees, but not the fee for the Cancellation Agreement (see below), and the Re-Stocking Fee (see below). The original fee for the Cancellation Agreement must be subtracted from the Re-Stocking fee. Note: You do not have to refund DMV fees if the buyer demands title at the sale and completes the registration themselves.

Measuring the “2 Days” for the Cooling Off Period: The two days of the cooling off period begin to run at time of delivery. The two days must be two regular business days for that dealer. In other words, if you sell the vehicle Friday evening at 7:00 p.m., and your dealership is open Saturday, but not Sunday, the buyer has until 7:00 p.m. Monday evening to return the car within the required two (business) day time period.

Two Day Cooling Off Period Fee

Vehicle Code Section 11713.21 (a)-(d) allows the dealer to charge the following maximum amounts for the two day cooling off period option contract:

- $75.00 for a vehicle with a cash price of $5,000.00 or less

- $150.00 for a vehicle with a cash price between $5,000.00 and $10,000.00

- $250.00 for a vehicle with a cash price of between $10,000.00 and $30,000

- 1% of the purchase price for a vehicle with a cash price between $30,000.00 and $40,000.00

Re-Stocking Fee

The dealer may also charge a re-stocking fee. This fee must also be put in writing. The restocking fee shall not exceed the following:

- $175.00 if the vehicle’s cash price is $5,000.00 or less;

- $350.00 if the vehicle’s cash price is less than $10,000.00; and

- $500.00 if the vehicle’s cash price is $10,000.00 or more.

Note: The dealer shall give the buyer credit for the cost of the 2 day cancellation agreement toward the restocking fee. For example, if the vehicle is sold for less than $5,000, the dealer can charge $75.00 for the option to cancel the contract. If the buyer then elects to cancel the contract within the next two days, the dealer can also charge the $175.00 re-stocking fee. However, the dealer must credit the $75.00 already paid for the option to cancel at the time the sale was made to the restocking fee. So, in effect, the dealer gets to keep the original $75.00 collected for the option to cancel, and an additional $100.00 for the re-stocking fee.

Trade Ins:

If, as part of the purchase, the buyer traded in a vehicle and was not charged for the cancellation option, the dealer shall return to the buyer, no later than the day following the day on which the buyer exercises the right to cancel the purchase, any motor vehicle the buyer left with the seller as a down payment or trade-in. If the dealer has sold or otherwise transferred title to the motor vehicle that was left as a down payment or trade-in, the dealer must pay the buyer either the agreed value of the vehicle as written into the contract or the fair market value, whichever is higher.

The Contract Cancellation Option Agreement

This is the agreement the buyer pays for and signs for the option to bring the vehicle back within two days of delivery. These can be obtained from your dealer form company provider. Failure to offer the buyer this Cancellation Agreement is a cause for action against a dealer’s license. The separate Sales Contractmust include a disclosure next to the place for the buyer’s signature notifying the buyer that a used vehicle (sold for under $40,000) may be returned and the purchase cancelled within the time frame specified in the Cancellation Option Agreement.

2 Day Cooling Off Period Sign-Posting You will need to conspicuously display a two day cooling off period notice, not less than eight inches high and ten inches wide, in each sales office and sales cubicle of your established place of business where written terms of specific sale or lease transactions are discussed with prospective purchasers or lessees. You will also need to place these notices in each room of your established place of business where sale and lease contracts are regularly executed. These notices must state the following:

“THERE IS NO COOLING-OFF PERIOD UNLESS YOU OBTAIN A CONTRACT CANCELLATION OPTION

California law does not provide for a “cooling-off” or other cancellation period for vehicle lease or purchase contracts. Therefore, you cannot later cancel such a contract simply because you change your mind, decide the vehicle costs too much, or wish you had acquired a different vehicle. After you sign a motor vehicle purchase or lease contract, it may only be canceled with the agreement of the seller or lessor or for legal cause, such as fraud. However, California law does require a seller to offer a 2-day contract cancellation option on used vehicles with a purchase price of less than $40,000, subject to certain statutory conditions. This contract cancellation option requirement does not apply to the sale of a motorcycle or an off-highway motor vehicle subject to identification under California law. See the vehicle contract cancellation option agreement for details.”

Prior Return Exception – No 2 Day Cooling Off Period Required

The dealer does not have to offer a contract cancellation option to the buyer if the buyer has returned a vehicle to the dealer under a contract cancellation option within the prior 30 days.

Document Returns During the 2 Day Cooling Off Period

The vehicle is sold, for DMV purposes, as of the date the buyer signs the contract and takes delivery of the vehicle, even if they later return the vehicle during the 2 Day Cooling Off Period. The buyer’s operation of the vehicle during the 2 Day Cooling Off Period has caused DMV fees to be due so you must continue to process the documentation according the to normal used vehicle rollback procedure. If you are unfamiliar with the rollback procedure, you will see later in these course materials to learn how to do a rollback. Also, do not allow the buyer to drive the vehicle on dealer plates after they have purchased it. That is prohibited, and it also exposes you to greater liability in case of an accident.

Buyer’s Responsibilities

The buyer must return the vehicle to the dealer within two business days. They must return the original contract and all original titling and registration documents provided. The buyer cannot exceed 250 miles (or higher agreed upon number). The vehicle must be free of all liens and encumbrances other than those arranged by the dealer or buyer at time of purchase. The vehicle must be returned in the same condition, less normal wear and tear.

Brokers and Consignment Dealers

Yes, the Car Buyer’s Bill of Rights law also applies to you. You must provide the buyer with 2 Day Cooling Off Period option for vehicles selling for less than $40,000, as well as comply with all the other requirements of Bill of Rights.

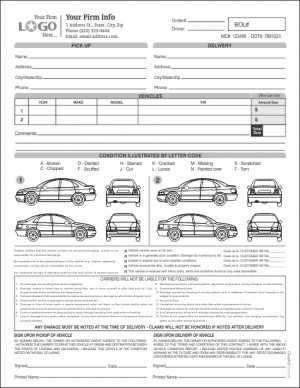

Vehicle Condition Forms

Dealers should prepare written vehicle condition reports to be completed at the time the vehicle is delivered to the buyer. This will document the condition of the vehicle at delivery. If the vehicle is returned with additional damage, the dealer can reject the vehicle, and the buyer is not entitled to a refund under the Bill of Rights.

“Certified” Used Vehicle Advertising Rule under the Car Buyer’s Bill of Rights

The Bill of Rights restricts which vehicles may be advertised/promoted as “Certified.” The following vehicles may not be advertised/promoted as “Certified:”

- Vehicles where the odometer reading is inaccurate;

- Vehicles reacquired by its manufacturer or a dealer pursuant to federal or state warranty laws;

- Vehicles where the title has a negative notice such as “Lemon Law Buyback” or “salvage;”

- Vehicles that have sustained damage substantially impairing their use or safety;

- Vehicles that have sustained frame damage;

- Vehicles without a completed inspection report indicating all of the components inspected;

- Vehicles where the dealer disclaims any warranty of merchantability; or

- Vehicles sold “AS IS.”

A dealer may not advertise a vehicle as “certified” unless prior to the sale the buyer is provided a completed inspection report showing all items inspected under the certification program.

Dealer Arranged Financing Rules Under the Car Buyer’s Bill of Rights

The Car Buyer’s Bill of Rights requires:

- Disclosure of customer credit scores;

- Disclosure of certain additional products and services and their costs; and

Finance Charge Limits between 2% and 2.5%

Disclosure of Credit Scores

A dealer who arranges financing, makes a credit sale, sells or otherwise transfers a conditional sales contract must disclose any three digit credit score obtained from the credit agency. The disclosure must be a separate document which includes the Name and address of the seller at the top. It must state the 3 digit credit score, and the name/address/phone of any credit agency providing the score. The document must also state the range of scores established by that credit agency.

Disclosure of Additional Products and Services and Their Costs

The Bill of Rights expands the categories of optional items, listed in Civil Code Section 2982, whose costs must be separately itemized in conditional sale contracts.

If the sale or lease includes any of the following:

- A service contract or maintenance plan

- Insurance product

- Theft deterrent or protection product

- Debt cancellation agreement (“gap” insurance)

- Exterior or interior surface protection

Then the dealer must provide the buyer a separate written disclosure providing a description and cost of each item, the total cost of all items, the amount of the installment payment if the buyer purchases the items, and the amount of the installment payment if the buyer does not purchases the items.

This disclosure must include the name and address of the dealer, and the date at the top of the document. If, after this disclosure has been provided to the buyer, the buyer changes his/her mind as to which items they want, you must create a new disclosure form. Hand writing in new items, or crossing out items the buyer no longer wants, will not be acceptable.

Failure to provide the buyer these disclosures is a cause for action against a dealer’s license and is a misdemeanor crime.

Finance Charge Limits Between 2% and 2.5%

When assigning a conditional sales contract, dealers are now limited to the following finance charges:

2 ½% for contracts up to 60 months

2% for contracts over 60 months

These limits do not apply when the dealer bears the entire risk of the buyer’s financial performance, or the assignment is more than 6 months after the date of the conditional sales contract. Receiving an amount higher than the authorized rate(s) is a cause for action against a dealer’s license and is a misdemeanor crime. However, if the dealer can prove the overcharge was an isolated incident; an real/honest error; the dealer has reasonable procedures to guard against such errors; and upon notice of the error the dealer promptly remitted the excess back to the buyer; then the dealer may avoid the penalties above.

“Adjusting” the Numbers

Dealers may not add charges for goods or services after negotiating the deal terms unless they obtain the buyer’s informed consent in writing. Dealers also may not inflate down payments, installment payments, or extend the maturity of a sale or lease contract for the purpose of disguising the actual charges or goods or services to be added by the dealer to the contract. Failure to uphold this law is a cause for action against a dealer’s license.

Bill of Rights Kit

There are a minimum of eight different forms you need to have on hand comply with the Bill of Rights. They are listed below. All of these are available through your form company providers.

- The 2 day cooling off period sign to post at your dealership.

- Contract Cancellation Agreement

- Financial Products & Services Disclosure

- Certified Used Vehicle Checklist

- Notice to Vehicle Credit Applicant

- Delivery Inspection Report

- Vehicle Return Inspection Report

- Vehicle Return Rejection Form

All forms must be continually reviewed by the dealer and/or your attorneys before use to insure compliance with the most recent rules and changes. The Bill of Rights rules are not difficult, but they must be followed. These simple forms will help you document your compliance and avoid problems with the DMV, your customers, and the civil and criminal courts.